The average child support payment is more than just a number. It’s a vital support for your child’s well-being and future.

The U.S. Census Bureau says the average monthly child support is about $430. But this amount can change a lot. It depends on your income, how many kids you have, and your family’s situation.

Learning about child support guidelines is important. It’s not just about following the law. It’s about making sure your kids get the financial help they need to do well. Each state has its own way of figuring out these payments. So, it’s key to know the rules in your area.

Table of Contents

Understanding Child Support Basics and Legal Framework

Child support is key to a child’s well-being when parents split up. Knowing state child support laws helps parents meet their legal duties.

Child support is a court order to help kids grow up well. It makes sure both parents help with their child’s needs, no matter their relationship.

Definition and Purpose of Child Support

The main goal of child support is to keep a child’s life stable. It covers important costs like:

- Housing and living expenses

- Educational costs

- Healthcare needs

- Extracurricular activities

Federal and State Guidelines Overview

The Uniform Interstate Family Support Act (UIFSA) helps set rules for child support across states. It makes sure child support orders work, even if parents live far apart.

Legal Obligations of Both Parents

Both parents must help with their child’s financial needs. Key duties include:

- Providing financial support for the child’s basic needs

- Participating in legal paternity acknowledgment

- Following court-ordered support payments

There are ways to enforce child support, like taking money from wages or tax refunds. The aim is to keep the child’s financial future secure.

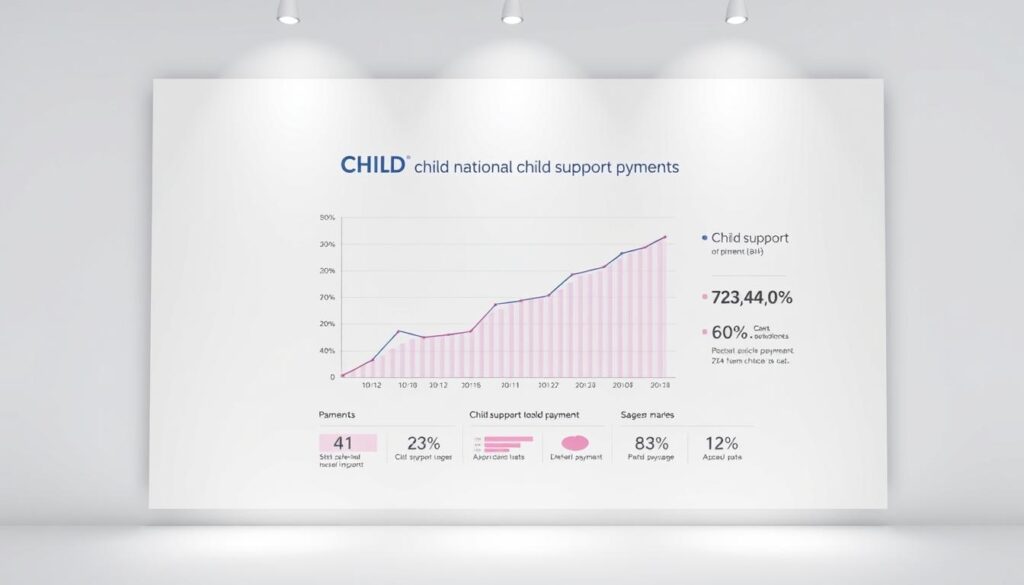

The National Average Child Support Payment

Understanding the national average child support payment is key to knowing how to support kids after parents split. The average monthly payment is about $721. But, this amount can change a lot based on different things.

Important details about child support payments include:

- Payments usually happen every month, often at the start

- The income of the custodial parent is very important in setting support amounts

- Where you live can also change how much you pay

Your child support payment might not be the same as the national average. This is because of several important factors:

- How many kids need support

- How much money each parent makes

- What the state’s laws say

- Each family’s financial situation

State laws and the local economy can also affect child support payments. For example, states in the Northeast often have higher payments than those in the South. Your own situation will decide how much support you need.

While the national average is a starting point, it’s crucial to talk to local legal experts and financial advisors. They can help you understand your exact child support duties.

How States Calculate Child Support Payments

Understanding child support payments can help you deal with financial responsibilities after a split. Each state has its own way of figuring out child support. There are three main methods used.

When you use a child support calculator, you’ll see three main models. States use these to figure out support payments:

- Income Shares Model

- Percentage of Income Method

- Melson Formula Approach

Income Shares Model Explained

The Income Shares model looks at the non-custodial parent’s income. This method tries to keep the child’s standard of living the same by using both parents’ income. For example, in Wisconsin, a single child’s support is 17% of the paying parent’s income.

“The goal is to ensure children receive financial support proportional to their parents’ combined earnings.” – Child Support Experts

Percentage of Income Method

This method is simple. Child support is a set percentage of the non-custodial parent’s income. For example, a $50,000 earner might pay about $708 a month for one child. The amount goes up with more kids.

The Melson Formula Approach

The Melson Formula looks at more than just income. It considers the child’s and parents’ basic needs. This way, the non-custodial parent can still afford their own living costs after paying child support.

So, your state’s rules will decide how child support is figured out. It’s a good idea to check local resources or talk to a lawyer.

Factors Influencing Support Payment Amounts

Understanding child support guidelines is more than just numbers. Courts look at many factors to make sure children get the support they need. The income of the custodial parent is important, but it’s not the only thing they consider.

Important factors that affect child support include:

- Number of children needing support

- Gross income of both parents

- Parenting time arrangements

- Healthcare and childcare costs

- Special needs of the child

Courts take a detailed look at child support. They look at net resources, not just gross income. They consider important deductions like federal taxes, Social Security, and health insurance.

Your situation can change the amount of support you pay. For example, if you have other financial duties or special parenting plans, these are considered. The aim is to meet the child’s basic needs and be fair to both parents.

The main goal is to support the child’s well-being and keep their standard of living the same after separation.

Some special things that might change child support include:

- Extended visitation periods

- Private school tuition

- Extra medical expenses

- Costs for travel during visitation

Child support rules are made to be flexible. They understand that every family is different. Getting help from legal experts can help you see how these rules apply to your situation.

Regional Differences in Average Child Support Payment

State child support laws show big differences in payments across the U.S. These changes come from many factors like local economy, living costs, and state rules.

Looking at child support payments across the country gives us interesting facts. It shows how much parents pay for their kids in different places.

Northeastern States: Higher Payment Trends

In places like Massachusetts and New Hampshire, child support is much higher. Payments can go over $1,000 a month. This is because of the high living costs and economic levels in these areas.

Southern States: More Moderate Approaches

In the South, like Virginia, child support payments are generally lower. They usually are about $400 a month. This big difference shows how important it is to know the local economy.

Western and Midwestern Trends

The West has its own way of figuring out child support. Colorado, for example, has one of the lowest average payments at $494 as of 2019.

| Region | Average Monthly Payment | Key Characteristics |

|---|---|---|

| Northeastern States | $1,000+ | High cost of living |

| Southern States | $400-$600 | Lower economic standards |

| Western States | $494 | Moderate payment levels |

| Midwestern States | $500-$750 | Variable economic conditions |

When dealing with child support, where you live matters a lot. State laws adjust to fit local economic situations.

Income Considerations and Payment Calculations

To figure out child support, you first need to know your net monthly income. A child support calculator makes this easier. It looks at different income sources and financial factors.

Courts don’t just look at your main job when figuring out child support. They also check other income sources, like:

- Employment wages

- Investment income

- Bonuses and commissions

- Rental property earnings

- Retirement benefits

The income of the non-custodial parent is key in setting support amounts. Most states use the income shares method. This means both parents pay based on their income and the child’s needs.

| Income Calculation Method | Key Characteristics |

|---|---|

| Income Shares Model | Combines both parents’ incomes to determine support |

| Percentage of Income | Bases calculation on non-custodial parent’s income percentage |

| Melson Formula | Considers parents’ basic needs alongside child support |

Courts might change the calculation if a parent lowers their income on purpose. This makes sure support is fair, even if someone tries to avoid paying.

Child support calculations are complex and differ by state. Talking to a family law expert can help you understand your situation better.

Support Payment Enforcement and Collection Methods

Child support enforcement is key to making sure kids get the financial help they need. When parents don’t pay, there are steps to collect the money and make them pay up.

The federal child support program helps a lot of kids, collecting $30.5 billion in 2022. About $114 billion in child support is uncollected each year. This shows how important it is to have strong ways to enforce payments.

Wage Garnishment Procedures

Wage garnishment is a main way to collect child support. Here’s how it works:

- Employers take a part of the non-custodial parent’s paycheck

- The money goes straight to the state child support agency

- Income withholding orders (IWOs) are used for every employment case

State Collection Agencies’ Role

State collection agencies are key in enforcing child support. They use many ways to get back child support:

- They intercept tax refunds

- They report delinquent payments to credit agencies

- They seize money from financial accounts

- They pursue license suspensions

Parents owing over $2,500 in child support might have their passport denied or revoked.

Interstate Payment Processing

The Uniform Interstate Support Act (UIFSA) makes sure states work together on child support. This helps track and collect payments when parents live in different places.

| Enforcement Method | Potential Consequences |

|---|---|

| Non-Payment | Up to 6% monthly civil penalties |

| Continued Delinquency | Potential jail time (up to one year) |

| Repeated Violation | Fines up to $2,000 |

Knowing about these methods can help parents pay their child support on time. This way, they can avoid serious legal and financial problems.

Support Modifications and Adjustments Over Time

Child support modification is a key legal process. It lets parents update their child support agreement due to big life changes. Most states allow changes if there are big financial or parenting arrangement shifts. In fact, 41 states use the income shares model, so changes can be based on income changes.

Courts carefully look at requests for child support changes. They need a lasting income change for at least a year. Judges check for big changes in jobs, income, or custody. A salary increase might not always mean a change, but big changes can lead to a review.

Your child support agreement can change. Many places let you reassess every three years, even with no immediate changes. They look at cost of living, education, healthcare needs, and each parent’s finances. The main goal is to protect the child’s best interests.

Remember, changing child support needs a formal legal process. Agreements between parents aren’t legally binding. If your life changes a lot, talk to a family law attorney who knows your state’s rules. You’ll need to show income changes, job status, and other important details to make a strong case.